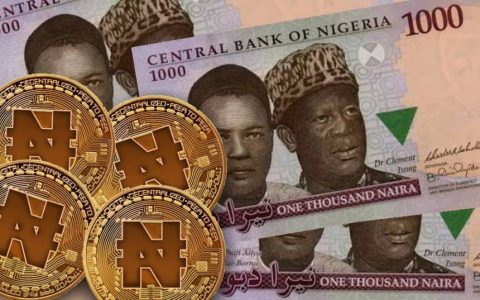

Digital Currency Will Facilitate Cross-Border Remittances, Payment System In Nigeria – CBN

Banking & Finance, Featured, Latest Headlines, News Across Nigeria Saturday, September 4th, 2021

(AFRICAN EXAMINER) – Central Bank of Nigeria (CBN) has assured Nigerians that the introduction of its digital currency, eNaira, will facilitate cross-border remittances and improved efficiency in payment system in the country. .

This is coming ahead of the Central Bank Digital Currency (CBDC), scheduled to be unveiled in the last quarter of this year.

CBN’s Director of Corporate Communications, Osita Nwanisobi gave the assurance while speaking with business correspondents in Abuja on Friday.

Nwanisobi said the eNaira had the potential to resolve many of the issues currently associated with cross-border payment and could help improve forex accretion and utilization.

He added that issuing a CBDC could reduce demand for foreign currencies as Nigerians could use CBDC to transact both locally and across borders in future.

He further explained that the eNaira will result in a marked improvement in its monetary policy transmission, adding that transactions on the eNaira will be at lower cost and greater time efficiency for all users.

The CBN spokesman also noted that it would complement rather than replace the paper money and coins currently in circulation, as well as enhance effectiveness in CBN’s monetary policy generally.

On the selection process that saw Bitt emerge as the CBN’s preferred technical partner for the implementation of the CBDC from a group of 15 prospective technical partners, Nwanisobi said the apex bank adhered to the provisions of the Bureau of Public Procurement as stipulated in the Public Procurement Act.

According to him, the bank based its selection assessment on technology ownership and control; implementation timeline; efficiency, ease of adoption; support for anti-money laundering and combating the financing of terrorism (AML/CFT); platform security; interoperability; and implementation experience, among others.

“Bitt was the first company to digitize a national currency on a block chain, thus creating the first synthetic CBDC, with the support of the Central Bank of Barbados Governor and the Minister of Finance. That system is still in operation today” he further explained.

While urging members of the public to embrace the eNaira upon unveiling, in the forthcoming weeks, he also enjoined stakeholders to support the bank’s policies, stressing that the CBN remained focused on its resolve of being a people-centered Central Bank.

Related Posts

Short URL: https://www.africanexaminer.com/?p=67447